With Australian businesses fighting for survival, and alongside COVID-19 developments in Victoria, the September ‘fiscal cliff’ presents an existential threat to possibly hundreds of thousands.

Using ABS and federal government data, Deloitte Access Economics estimates around 240,000 businesses in the hospitality, professional services, and transport industries, in particular, are at high risk of failure come September.

That’s nearly 10% of all Australian businesses.

Under the current federal government arrangements, businesses will receive their last JobKeeper payment on 27 September – around the same time as many rental and loan repayment deferral agreements are also set to end.

This will put enormous pressure on the viability of many businesses, and the economy as a whole.

Key questions for policy-makers, lenders, insurers, suppliers and utility providers who rmr/ely on the business-to-business market will be: how many clients might close down? And when?

Industry impacts of COVID-19

Around 40% of businesses across hospitality, professional services, and transport have indicated their cash reserves can cover less than three months of operations in the current environment. While it’s expected the business environment will improve over the next three months as restrictions are eased (but don’t forget Melbourne), it’s not known whether any improvement will be enough to enable businesses to recover, let alone survive, without JobKeeper support.

Within sectors, it appears smaller businesses, with their higher fixed costs, smaller cash reserves and barriers to lending, will find it more difficult to survive.

The ABS Business Indicators survey published on 24 June observed that nearly 30% of small businesses have cash on hand to support operations for less than three months.

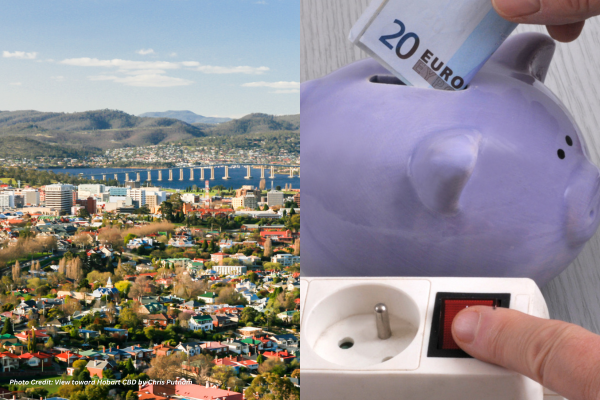

All states and territories at risk?

Some parts of Australia are likely to face higher risks than others. There are two reasons for this – the degree to which restrictions have hurt economic activity, and the state or territory’s exposure to high risk sectors.

Proportion of businesses accessing JobKeeper in April, by state and territory

Unsurprisingly, this doesn’t bode well for Victoria, where the latest outbreaks have led to increased restrictions. Already one of the states with the highest proportion of businesses claiming JobKeeper, along with New South Wales, this new round of restrictions is likely to create further problems. In addition, one in four businesses in Victoria operate in the high risk industries identified above.

Businesses operating in Australia’s two territories face relatively lower risks. While around 30% of those in the Northern Territory and ACT have accessed JobKeeper, this is much lower than the rest of the country. In addition, these two economies are relatively sheltered from the impacts of COVID-19 due to quicker easing of restrictions, and a high exposure to the public sector.

A response?

Business insolvency hurts business owners, employees, as well as creditors and suppliers.

Canberra may well announce specific packages to support businesses beyond September. But in the meantime, it’s incumbent on suppliers, creditors and insurers to prepare contingency plans for a significant rise in hardship and bad debts.

To do so, it’ll be important to consider the characteristics of the businesses they deal with – the industry they operate in, their size, and their existing financial resilience, including the ability to borrow and service any additional funds.

In many instances, business owners and the directors of those businesses will also need to consider whether a voluntary administration process may maximise the chances of their business surviving – allowing for a moratorium against certain creditor claims and the opportunity to restructure its debts and reset its balance sheet for future success. When used appropriately, administration can be an efficient and cost effective restructuring tool.

Society also needs to overcome the historical stigma associated with external administration, and recognise that, in many instances, these business owners and directors, through no fault of their own, are making tough decisions which they believe are in the best interests of all stakeholders.

This is a tricky analysis to get right, particularly as nobody can know what the future might hold. But it is important to get the right advice and be prepared so that Australian businesses, big and small, can minimise the flow-on effects of that looming ‘fiscal cliff’.

source: NSW Government

Aiza is a journalist and content writer. She is the content producer of Public Spectrum.